Read also Part 1 of our Door Drop series, with interviews with the leading European experts.

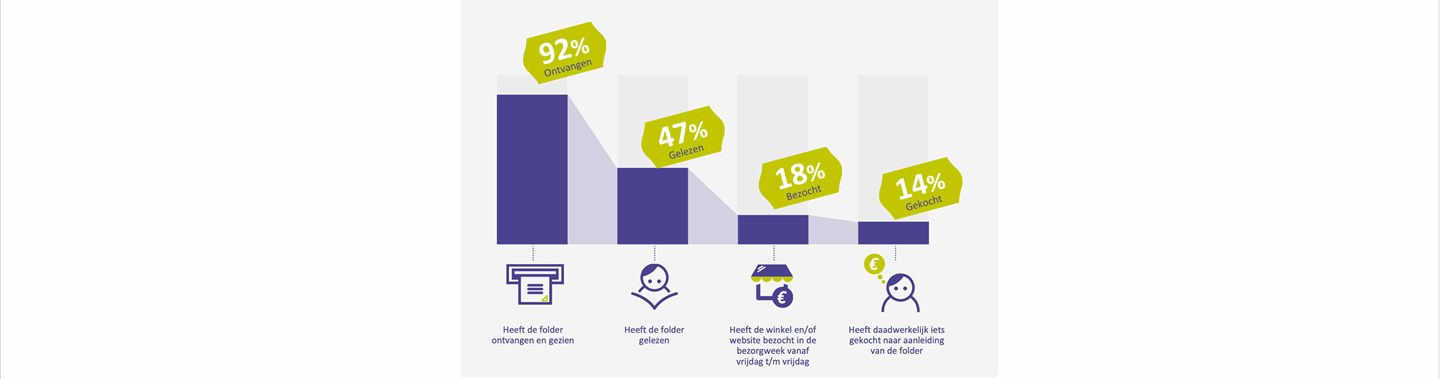

Despite challenges faced by environmental concerns, the rise of digital and the economy over the last few years, there’s no doubt that door drops remain a powerful promotional sales tool – and one that is crucial in a customer acquisition strategy.

Recently, the double-edged impact of the pandemic lockdowns which confined us to our homes over the last few years meant internet use surged to record levels and the use of door drops increased. But far from being a win for online marketers, advertisers found it increasingly difficult to get heard in a sea of digital noise.

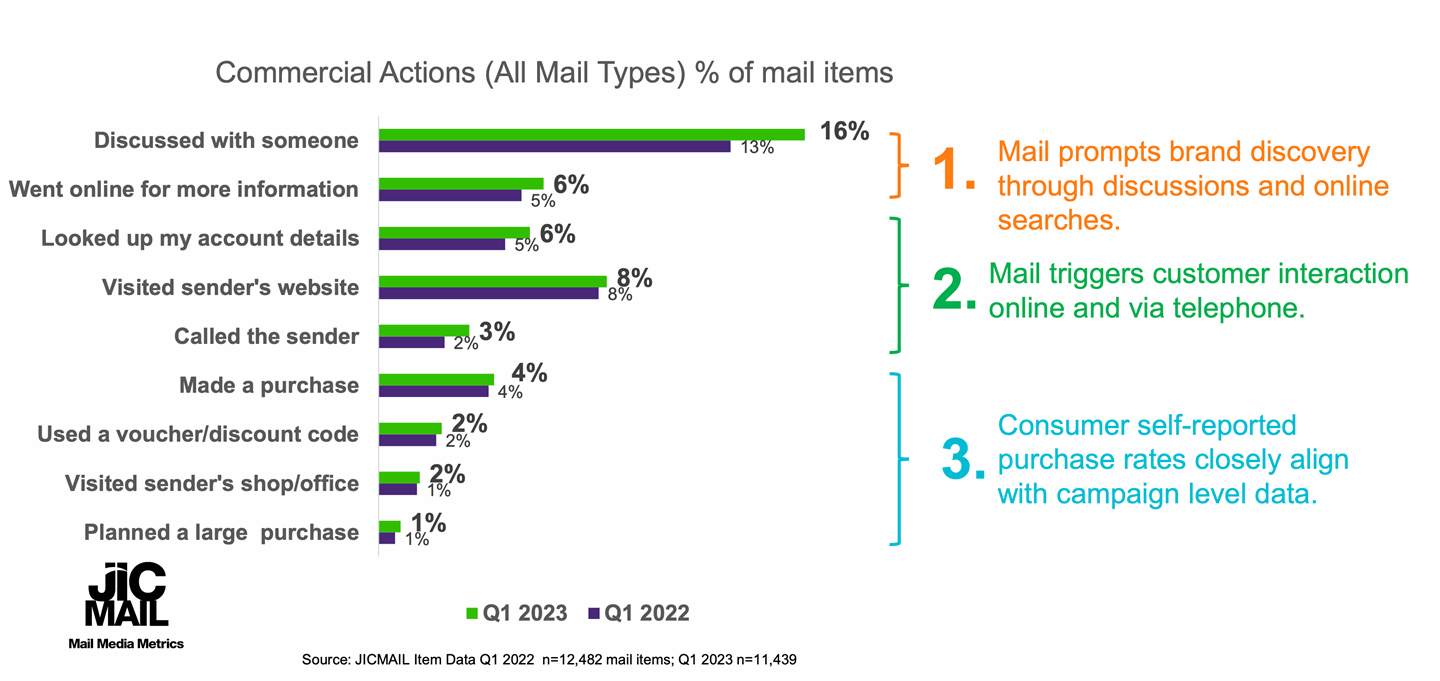

Step forward door drops – a creative, tactile medium that has the cut-through to get one-on-one attention from a potential customer. Attention that’s an increasingly important metric in a marketing promotion strategy, and it’s here that print excels. JICMAIL’s 2023 ‘The time we spend with mail’ attention study found that mail is more attention efficient than virtually all other media channels, making it a cost effective channel.

1. The COVID-19 rebound

So, with such compelling evidence of effectiveness, what’s the problem? Well, unfortunately, the COVID-19 pandemic meant that demand for paper increased, while paper manufacturers had decreased the production volume. Virgin and recycled fibre became more expensive, and since 2022, inflation has pushed paper and logistics costs up. The result was that door drops became a more expensive channel. However, that was temporary and we are now seeing them decreasing again.

In addition, as we explained in Part 1 of our Door Drops Series, letterbox marketers in European countries are faced with increasing limitations on door drops due to local municipalities introducing a permission-based system and more selective distribution. Households need to display a sticker on their letterbox that shows their interest in receiving door drops (Oui Pub and Yes stickers).

Then there’s the concern around the carbon impact of production, distribution, waste and recycling. But as Mark Davies explains below, this reaction was likely provoked in the Netherlands at least, by Amsterdam’s soaring waste collection rates, which was to be expected given that The Netherlands distributes by far the most flyers and leaflets per week – on average around 28. Reassuringly, the industry is working to dispel some of the sustainability myths around paper versus the carbon footprint of digital.

2. Changes in the retailers’ advertising strategy – transformation to digital

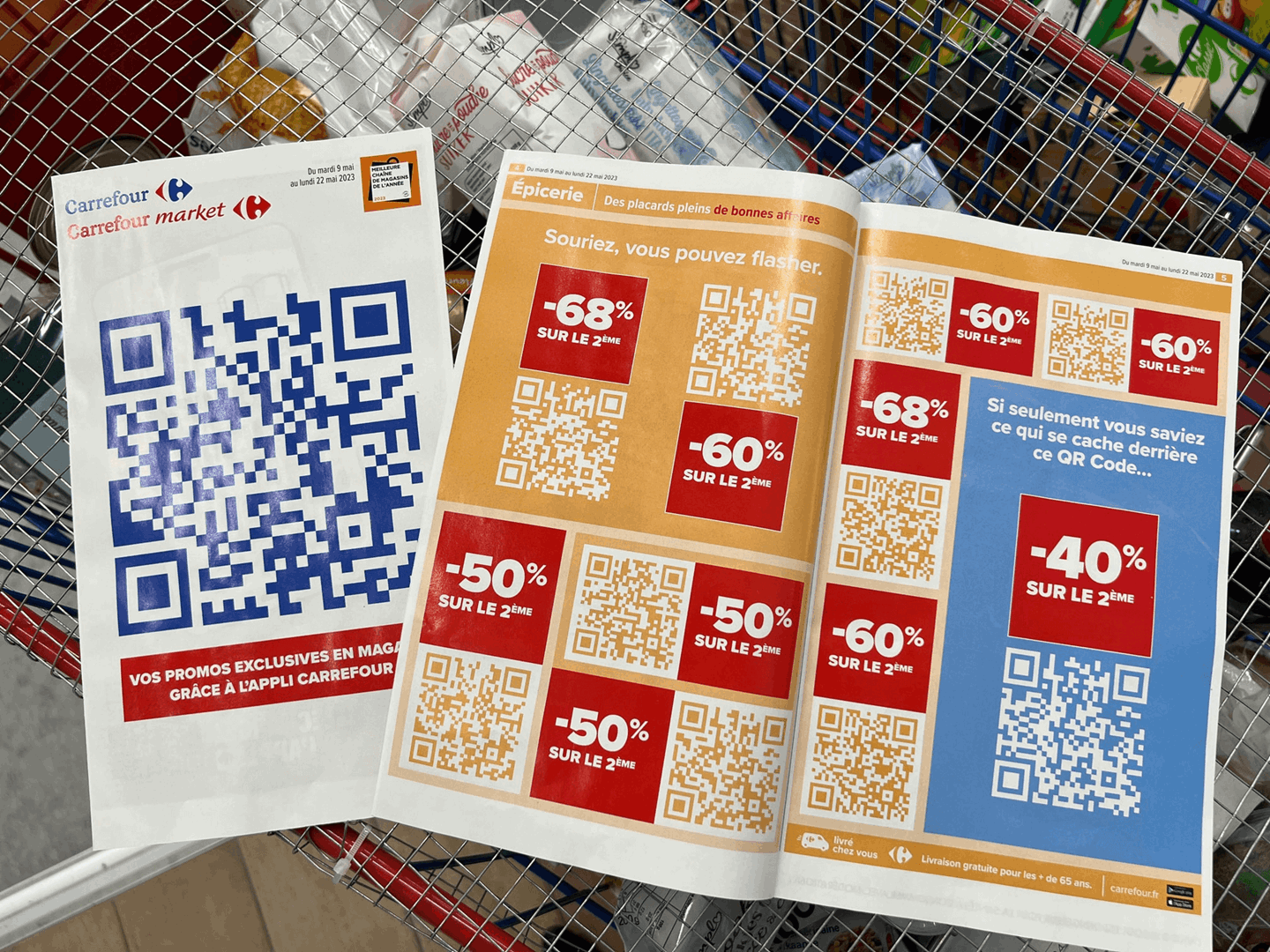

All of these factors, as well as a desire to keep advertising revenue for themselves, have provoked retailers to explore the potential of advertising on their own digital apps and websites instead. It’s the brands stocked by a retailer who largely fund the production and distribution of door drops, and retailers have seen the financial benefits in shifting that revenue to their own coffers by advertising on their own digital channels.

A threat to the future of door drops? In the short term, potentially. But there are flaws in the retail media strategy. Door drops can offer 100% reach of households, while digital is limited to the number of people who, for example, will download and use an app.

Also, many retailers operate on a franchise basis – and the independents might decide not to follow the own media route. A case in point was when German DIY chain OBI decided centrally to stop door drops, while their independents shops continued to use them.

3. Managing the household budget in times of inflation

Then there’s the fact that for local outlets and customers in rural areas with bad or no broadband connection, highly popular door drops are a lifeline to staying informed about offers and saving money in the current economic crisis. As we mentioned before, the newly launched 150€ magazine in France is a way for retailers to get money off coupons to customers and promises to save the customer just that – 150€. But it’s unlikely the subscribers to the magazine would want every item on offer. Door drops, leaflets and brochures let customers compare sales promotion offers from various retailers and brands. The fact hasn’t changed that door drops play an important role for those living outside major cities.