The ISBA/PwC is the first study involving actual campaigns from premium brands. It shows the dramatic ineffectiveness of online ads matching the right audiences. With print also slowly shifting to programmatic print questions might be raised about the value benefits for publishers.

The Power of Print in a glance

- Only 12% of all ad impressions paid for can be matched

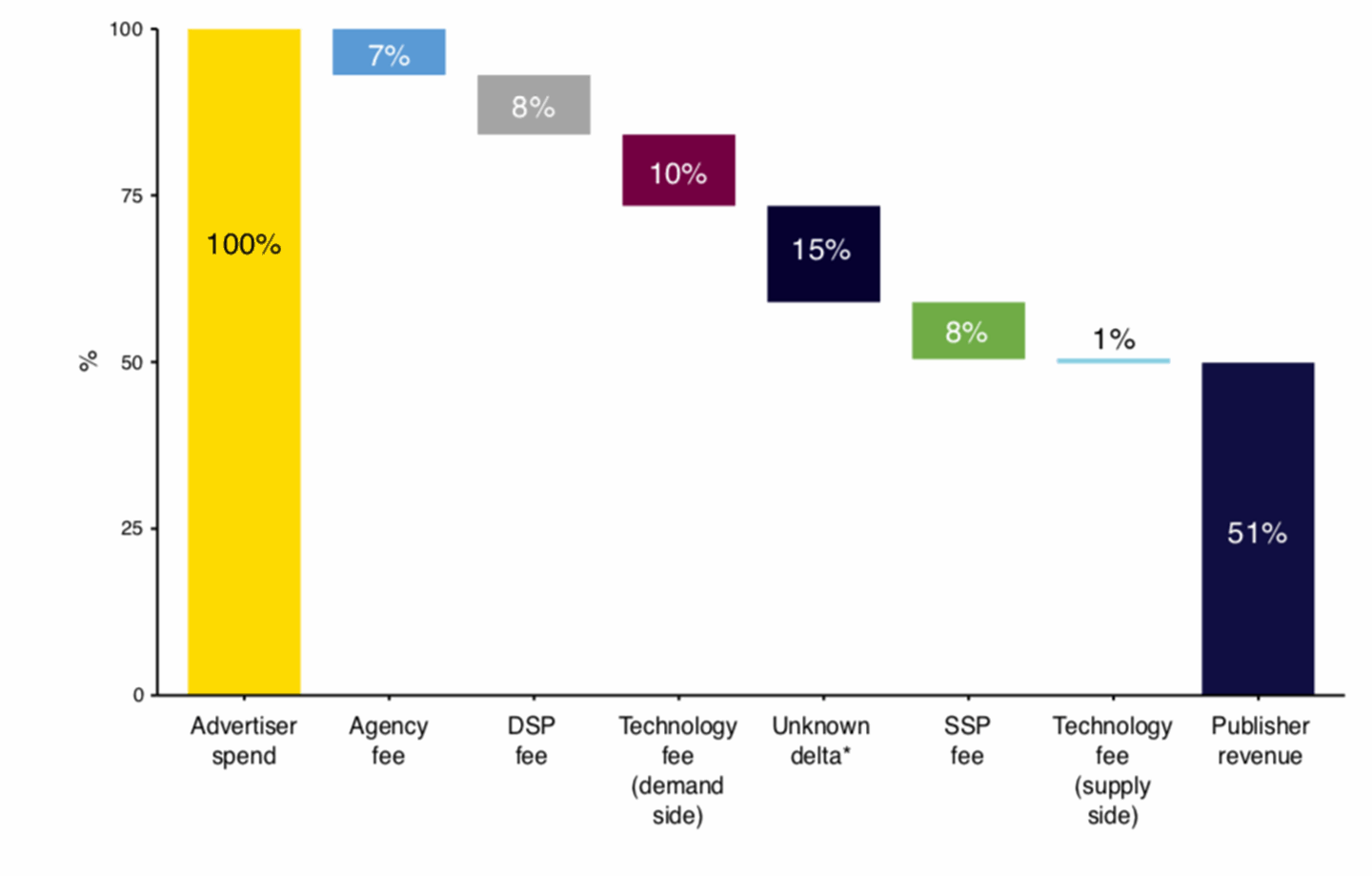

- Publishers receive just over half (51%) of programmatic spend

- The supply chain "has been deliberately designed with opacity in mind"

In a first-of-its-kind study, ISBA (the trade body for UK advertisers) and PwC found that only 12% of ad impressions can be accounted for.

The sheer scale of lost adspend, disorganisation and murkiness in the £2bn programmatic advertising supply chain has been laid bare in a first-of-its-kind report by trade body ISBA and auditors at PwC.

The advertiser-funded ISBA Programmatic Supply Chain Transparency Study found that only a fraction (12%) of 267 million ad impressions, paid for by brands to be served on publishers’ websites, could be accounted for or "matched".

The rest could not be mapped due to low data quality, analysts from PwC found, citing huge difficulties in getting like-for-like data from various players in the ecosystem.

From that fraction of ads that were matched, PwC found that, on average, nearly one in six (15%) of advertising pounds spent on these ads are being lost in the system. This "unknown delta" represents money that is spent on programmatic ads but can’t be found to have been delivered as an ad that an internet user has actually viewed.