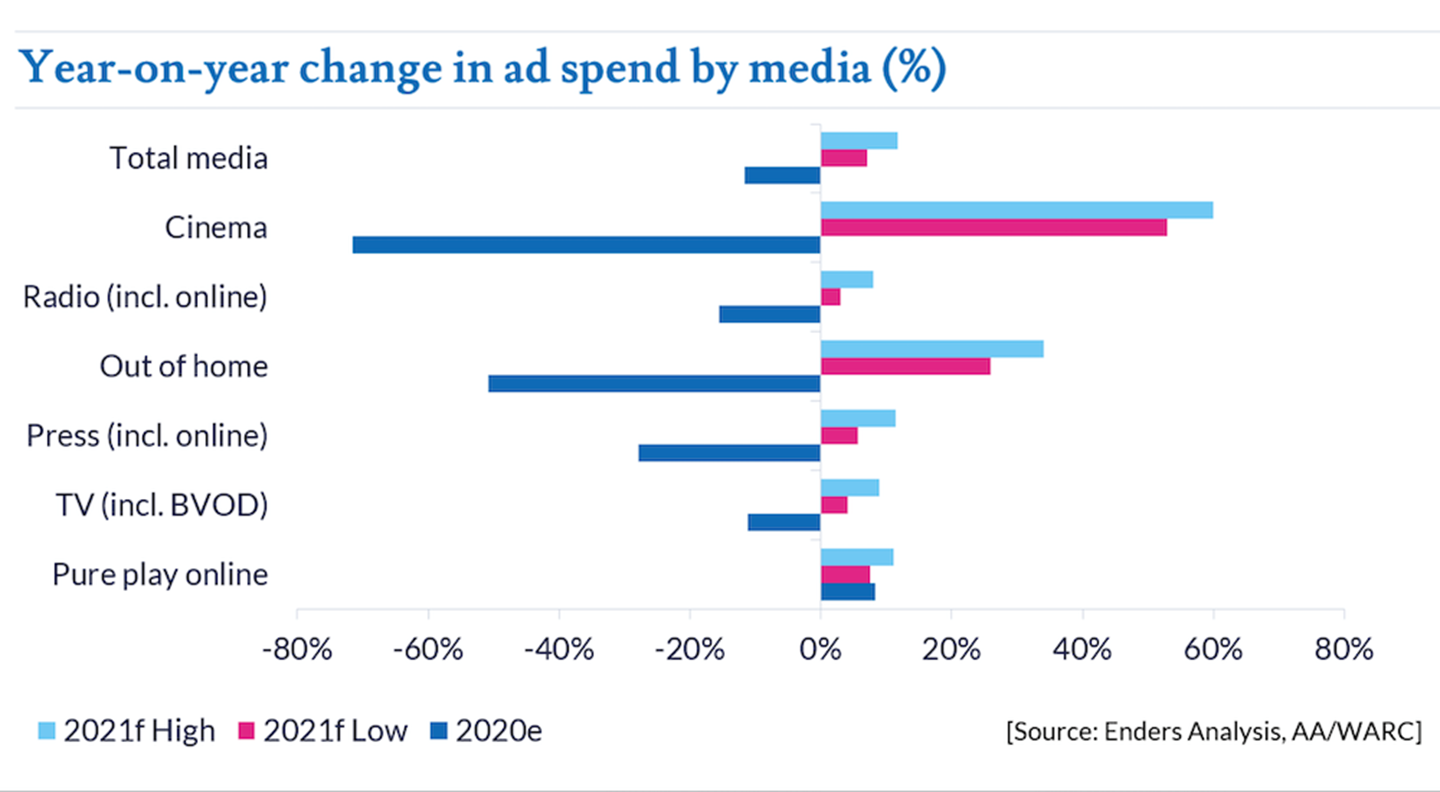

Enders Analysis indicated a strong decline of advertising among almost all channels during 2020. But these same channels are expected to rebound and attract more advertising money in 2021. Newspaper and magazine brands also show their resilience.

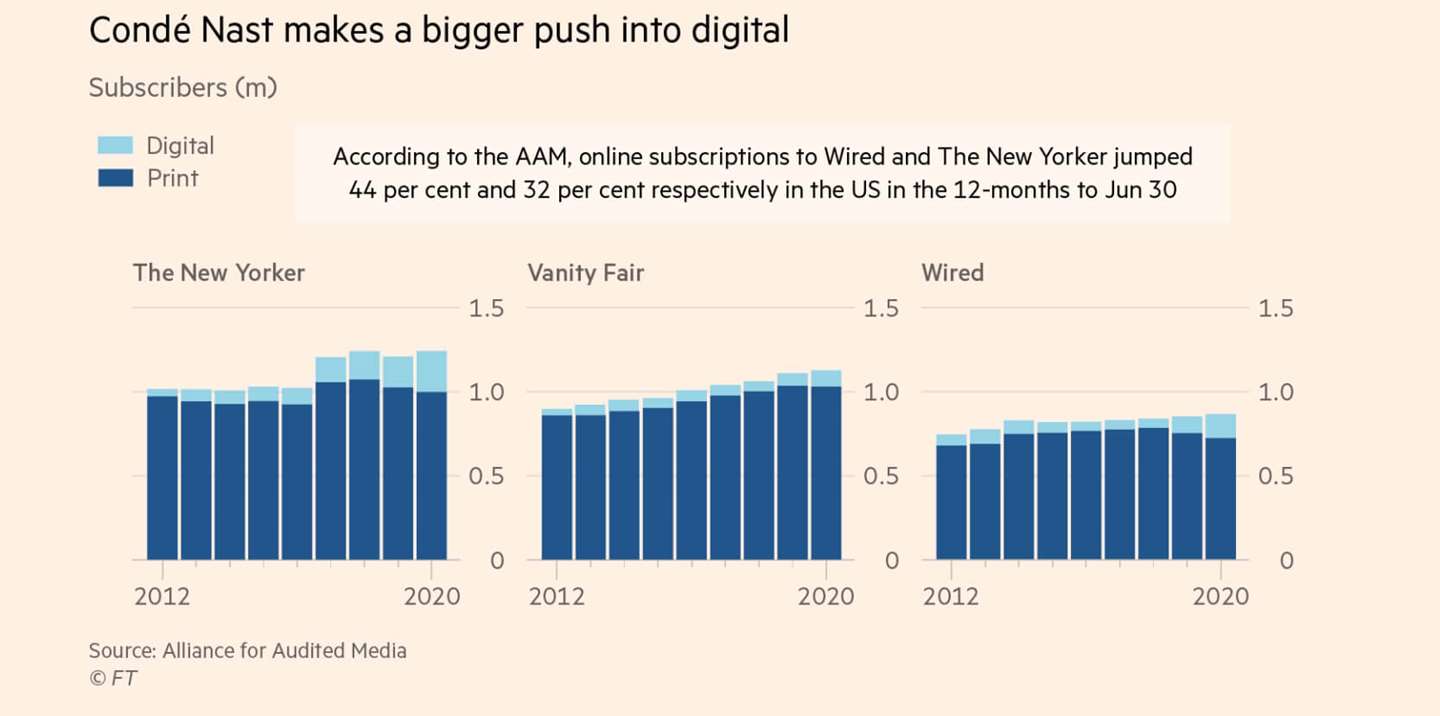

Magazines in the USA have taken different decisions to cope with the reduction of advertising revenues. Some publishers decided not to make any changes to their strategy. Others changed the publication frequency, like numerous titles from Hearst (e.g. Cosmopolitan, Elle, Harper’s Bazaar, Marie Claire), and Condé Nast (Vogue, Vanity Fair). Meredith, the third and largest US publisher, also reduced the frequency of some publications, but this decision was apparently taken prior to the Covid period.

Says Doug Olsen, President of Meredith Magazines: “We certainly looked at frequency changes, but we decided that the consumer strategy that we had was going to override any advertising shortfalls in the near term anyway”.

An interesting point to note is Hearst made the most changes to frequency, but the least in terms of headcount and pay when it came to saving costs amid the pandemic. To date its only mass layoff was 59 staffers at O. In contrast, Condé Nast implemented pay cuts, laid off 100 staffers and furloughed the same amount, while Meredith let go of 180 staffers across the whole business, cut pay and paused the dividend. Both companies have since restored full pay.

Other titles halted their publication, but will probably restart in 2021. The most radical decision, taken by Playboy, was to cease print operations entirely. The economic disruptions from COVID-19 were too much for its already strained print operations to bear.